Markets shift sharply after Fed cut as volatility builds

Markets shift sharply after Fed cut as volatility builds

Markets shift sharply after Fed cut as volatility builds

The Federal Reserve delivered its third rate cut of the year, trimming the federal funds rate to 3.5%–3.75% and signalling a more cautious approach ahead. According to reports, the reaction across markets was swift and uneven: Bitcoin dropped more than $2,000 in a day before bouncing, gold climbed toward $4,235, and equities staged a relief rally. With economic data still trickling in after the prolonged government shutdown, policymakers are contending with inflation near 3% and a committee struggling to agree on the next steps.

Analysts noted that these abrupt cross-asset moves show how primed investors are for even small changes in the Fed’s tone. Powell said the central bank is “well positioned to wait and see,” and markets are now recalibrating their expectations deep into 2026.

What’s driving the Fed’s hawkish cut

Data showed that the Fed chose a 25-bps cut rather than the 50-bps that some traders were anticipating, maintaining room to manoeuvre as inflation continues to run above target. Polymarket probabilities were already pricing in a cut with near certainty before the announcement, but the modest size of the move still sparked sharp intraday volatility. Bitcoin lost another $500 within minutes of the statement before steadying. Analysts note that crypto’s sensitivity has eased somewhat as leverage has cooled, with speculative positioning down to around 4–5% of market cap from 10% earlier this year.

Political pressures are becoming harder to ignore. Powell faces only three more meetings before President Trump selects a new Fed chair, likely someone more inclined toward lower rates. Prediction markets, including Kalshi, give Kevin Hassett roughly a 72% probability of being nominated. That prospect is already shaping expectations and complicating the Fed’s communication strategy, particularly as officials strive to maintain their sense of independence.

Why it matters

The 9–3 split at the meeting underscored the deep policy divide at the heart of the FOMC. Stephen Miran called for a more aggressive cut, while Jeffrey Schmid and Austan Goolsbee preferred no move at all - an unusual blend of hawkish and dovish dissent. Anna Wong of Bloomberg Economics described the overall tone as “leaning dovish,” easing fears that the Fed might pair the cut with a warning of fewer reductions ahead.

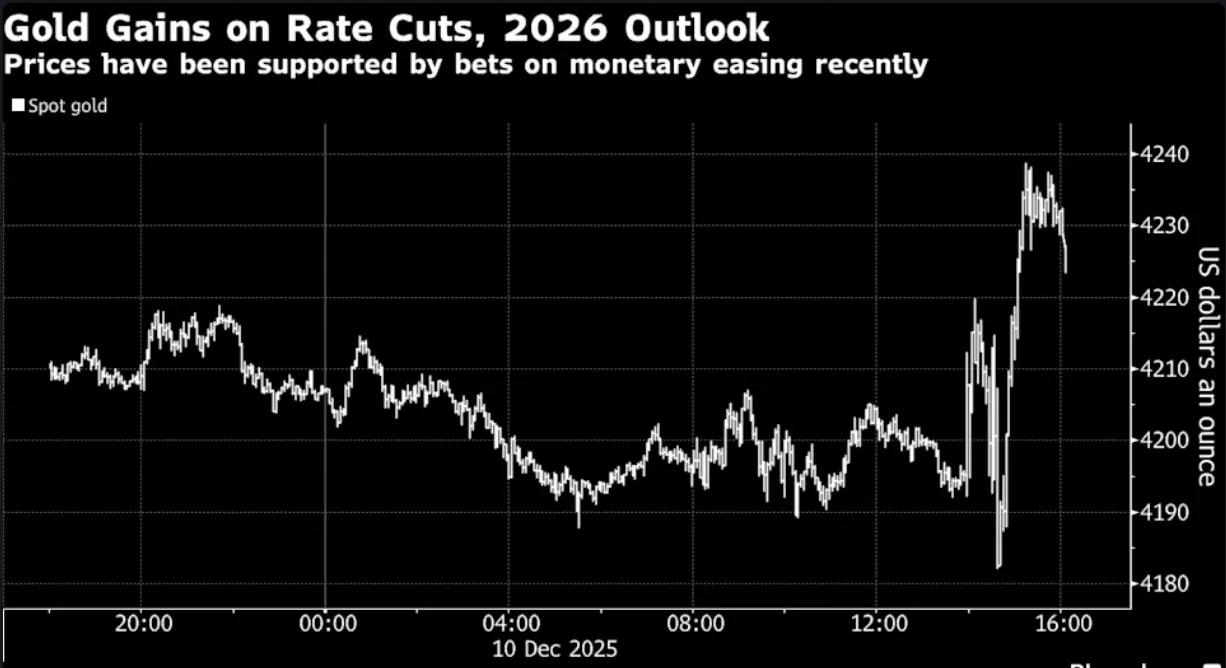

This tension is being felt across various asset classes. Bitcoin’s multi-day swings highlight the gap between investor hopes for faster easing and the Fed’s desire to proceed gradually. Gold’s strength shows how quickly traders pivot to safety when policy direction is less certain.

Even so, the Fed still projects just one cut in 2026 - unchanged from September - while markets continue to anticipate two. That disconnect turns every Fed statement into a potential trigger for volatility.

Impact on markets, businesses, and consumers

Crypto traders felt the impact most acutely. Bitcoin’s $2,000 drop over the past day reflects not only shifting views on monetary policy but also broader fragility in sentiment. While leverage has normalised, the asset remains highly reactive to macro developments, suggesting more turbulence ahead as markets digest the Fed’s slower path.

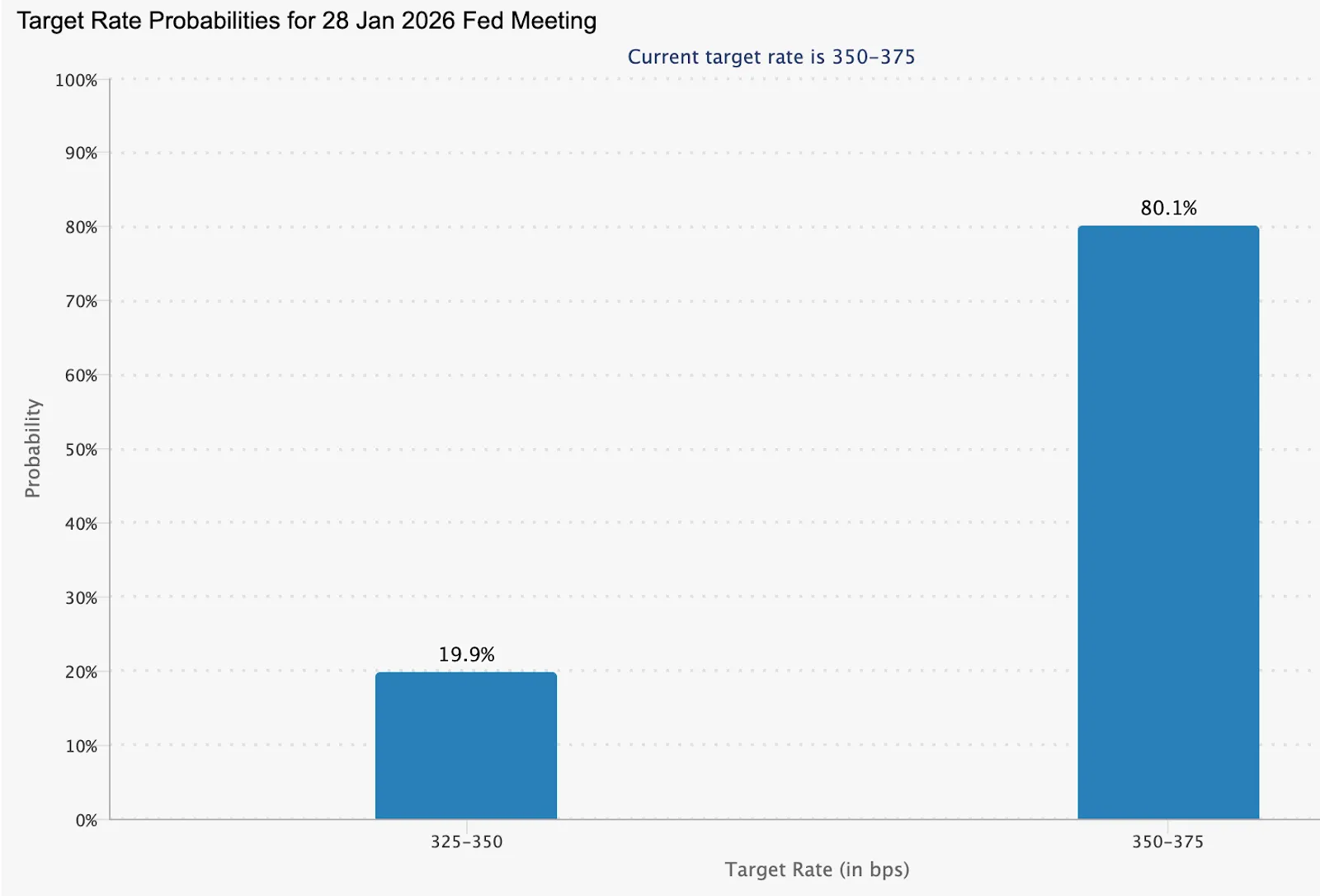

Gold briefly touched $4,230 before easing slightly, supported by falling yields and renewed interest in safe-haven assets. The CME FedWatch tool now shows an 80% probability that the Fed will hold rates in January, up from 70% beforehand.

TD Securities’ Bart Melek said the Fed’s plan to purchase $40 billion in T-bills each month resembles a form of “mini-quantitative easing,” likely to support gold into early 2026. Silver continued its powerful run, hitting a record $61.8671 as tightening supply conditions pushed prices sharply higher.

FX markets were equally active. EUR/USD held firm as traders weighed Powell’s comments alongside Christine Lagarde’s upbeat assessment of eurozone growth. With the ECB expected to lift its forecasts again, investors are reassessing how much room the bank has to cut further. A stronger outlook in the bloc typically softens the dollar’s near-term advantage, especially if the next Fed chair leans dovish.

Geopolitical developments added more uncertainty. Reports that President Trump has given Volodymyr Zelensky a Christmas deadline for progress on a peace proposal with Russia added another variable to safe-haven demand. Any significant breakthrough could reduce appetite for assets like gold, though for now, policy uncertainty is keeping bullion elevated.

For households and businesses, the picture remains mixed. Rates may start drifting lower, but consumer borrowing costs - from mortgages to credit cards - remain far above pre-inflation norms. Layoff announcements above 1.1 million this year suggest the labour market may be less resilient than headline figures imply.

Expert outlook

Powell reiterated that the Fed needs more time to assess how this year’s cuts influence economic conditions. Although officials upgraded their 2026 GDP forecast to 2.3%, they expect inflation to remain above the 2% target until 2028. Markets continue to price in two cuts in 2026, with the next one likely around June - putting investors and policymakers on increasingly divergent tracks.

According to market watchers, the January meeting may not produce any policy changes, but it will be pivotal in setting the tone for 2026. Traders will focus on how Powell interprets incoming labour and price data, how quickly liquidity injections filter through the system, and whether the approaching leadership transition begins to influence the Fed’s stance. Until then, crypto, commodities, and fixed income are likely to remain volatile.

Key takeaway

The Fed’s latest 25-bps cut looks simple on the surface, but the surrounding context is anything but. Political pressure, inflation that refuses to settle, and limited data visibility have created fertile ground for swings across Bitcoin, gold, and broader markets. With the committee divided and investors pricing in a faster easing cycle than the Fed projects, attention now turns to January, where the next signals about the path ahead will emerge.

Gold and silver technical insights

Gold is consolidating just beneath the US$4,240 resistance area, where recent candles hint at hesitation and light profit-taking after its strong advance. The Bollinger Bands have narrowed, indicating a phase of volatility compression that often precedes a sharp directional move. Price action remains comfortably above the US$4,190 support, but a daily close below that level could trigger momentum-driven selling, with the next downside pocket sitting near US$4,035.

The RSI holds slightly above neutral, reflecting mild bullish momentum without signalling exhaustion. A breakout above US$4,240 would expose US$4,365, while a failure to defend US$4,190 risks a deeper retracement.

Silver is still benefiting from persistent supply tightness and elevated borrowing rates, but price action is now testing a pivotal zone after its record run. The metal is trading close to its upper Bollinger Band, showing robust upside pressure yet also increasing the likelihood of short-term pullbacks. Support rests around US$59.80, and holding this area would maintain bullish momentum. A break above the recent peak at US$61.8671 could extend the rally, while a dip below support opens room for a corrective move toward US$57.40.

The performance figures quoted are not a guarantee of future performance.