USD/JPY forecast: The psychological battleground testing Japan’s monetary resolve

USD/JPY forecast: The psychological battleground testing Japan’s monetary resolve

USD/JPY forecast: The psychological battleground testing Japan’s monetary resolve

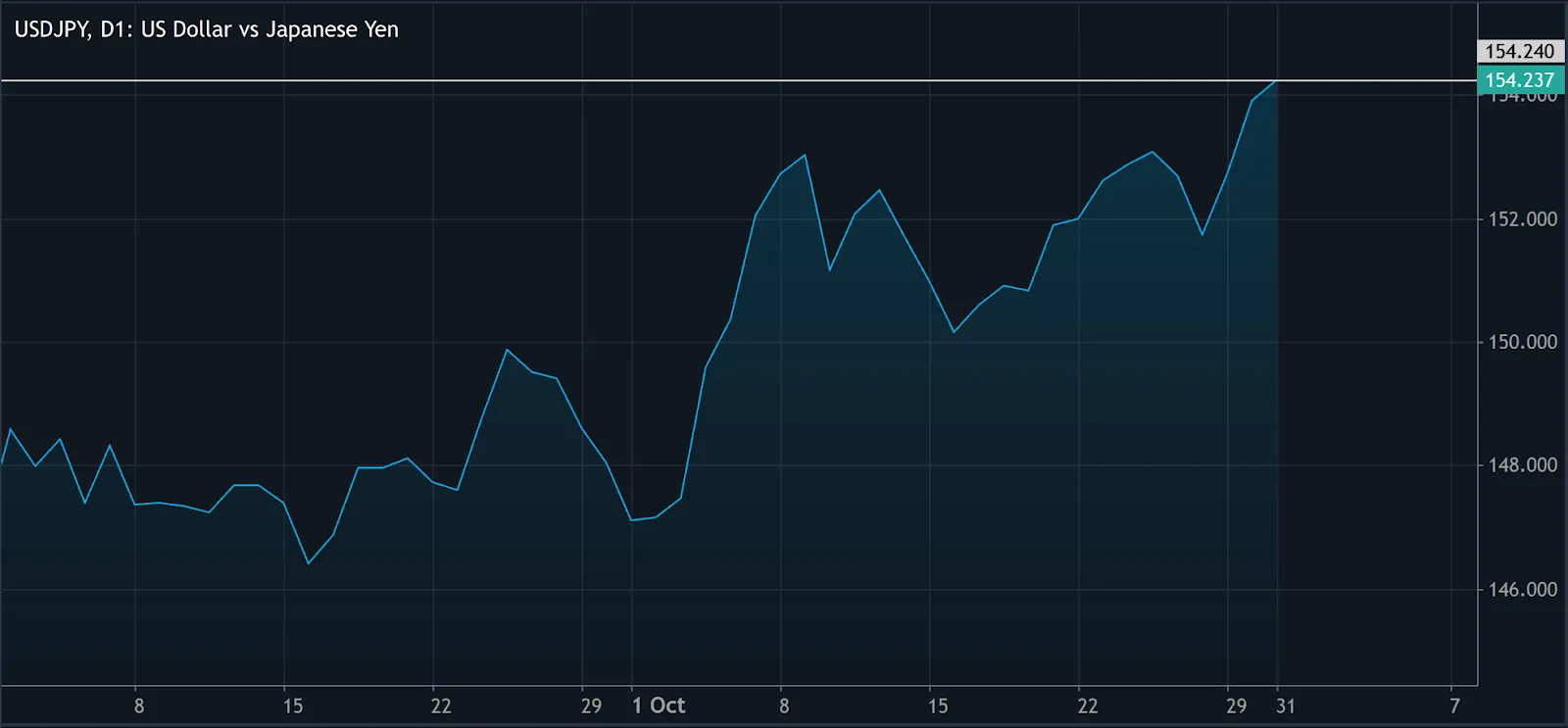

According to reports, USD/JPY’s climb beyond 154 per dollar marks a new phase in Japan’s ongoing policy dilemma. The move reflects the widening gap between the Bank of Japan’s (BOJ) caution and the Federal Reserve’s resilience - a divide that’s driving traders to question how much further Tokyo can tolerate yen weakness.

With inflation running above target and the government issuing repeated verbal warnings, the market has turned Japan’s currency into a test of credibility. The key question now: will USD/JPY march toward 155, or will a long-awaited BOJ policy shift turn the tide?

Key takeaways

- BOJ inaction vs. Fed firmness: Japan’s central bank held rates steady again, while Powell downplayed the likelihood of a December rate cut - widening yield spreads and fuelling dollar strength.

- 154 as a market trigger: The level now serves as a psychological pressure point, where traders gauge Japan’s willingness to defend the yen.

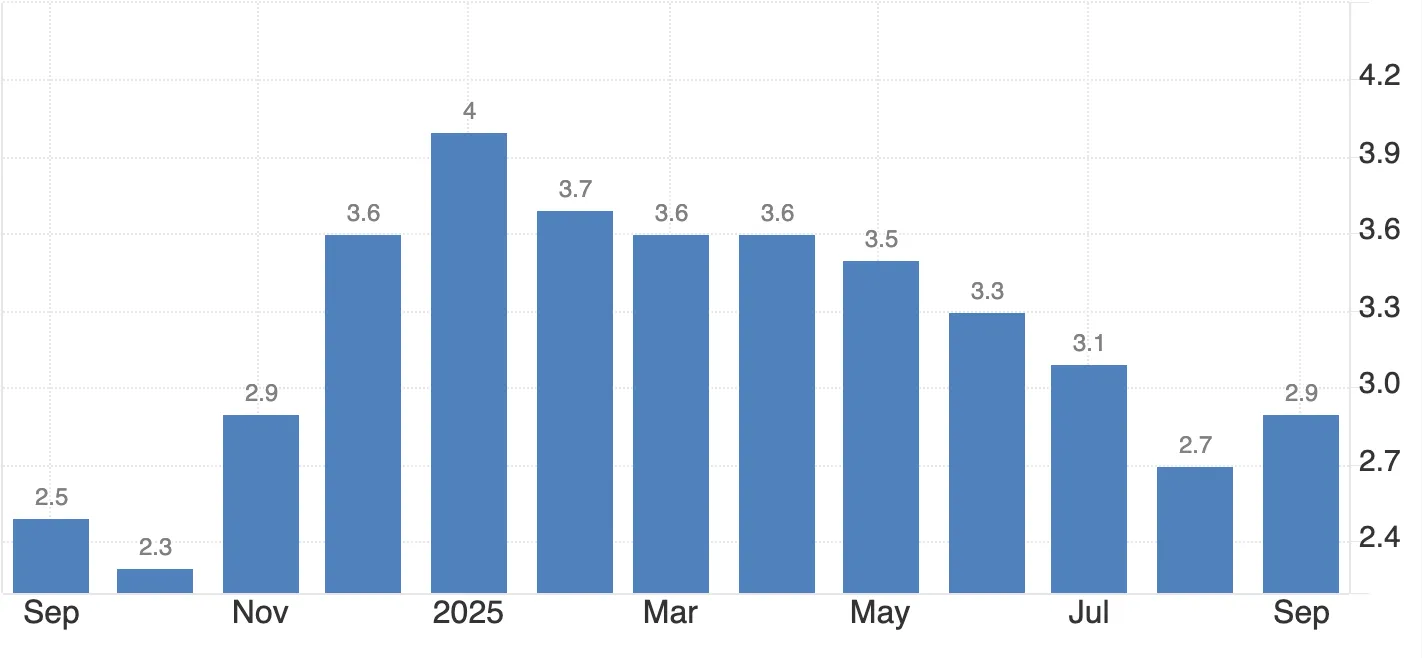

- Persistent inflation: Tokyo CPI rose 2.8% YoY, exceeding forecasts, yet Governor Ueda continues to prioritise wage growth over immediate tightening.

- Verbal intervention fatigue: Finance Minister Katayama’s remarks offered only temporary support for the yen as markets demanded tangible action.

- Credibility on the line: Without a decisive policy signal, Japan risks deepening investor scepticism and prolonged yen weakness.

BOJ’s hesitation leads to Japanese yen weakness

The BOJ’s latest decision to hold interest rates steady reaffirmed the perception that Japan will remain the global outlier in monetary policy. Governor Kazuo Ueda has hinted at the possibility of a hike later this year but insists it depends on wage growth data - effectively delaying any move until 2026.

By contrast, Federal Reserve Chair Jerome Powell reinforced the dollar’s strength with a firm message that further cuts aren’t guaranteed. This divergence continues to anchor USD/JPY above 154, a trend clearly reflected on Deriv MT5, where traders maintain long exposure to the pair amid persistent policy contrast.

USD/JPY at 154: Where psychology meets policy

The 154 level has become more than just a number on a chart; it’s a line that defines market psychology. Traders recall previous interventions around similar levels, using 154 as a reference point to test the government’s patience.

Each official remark - however stern - is now treated as a market sentiment cue rather than a deterrent. The yen’s brief recoveries following such comments tend to fade quickly without BOJ follow-through.

In essence, 154 represents a standoff between traders betting on continued dollar strength and policymakers defending their credibility through words, not actions.

Japan inflation says “move”, policy says “wait”

Tokyo’s October inflation accelerated to 2.8% year-on-year, with both core and core-core measures above 2.8% - indicating persistent price pressures across the economy.

Despite this, Ueda continues to stress that rate hikes will only follow “sustainable wage momentum.” That cautious stance has created a disconnect between economic data and monetary response.

The mismatch fuels a steady wave of speculative yen selling, as traders view BOJ patience as policy paralysis rather than prudence.

Government warnings and the illusion of control

Finance Minister Satsuki Katayama’s declaration that Japan is watching FX moves “with a high sense of urgency” briefly lifted the yen, but USD/JPY quickly rebounded.

The fleeting reaction underscores the diminishing power of verbal intervention. Without a coordinated or policy-backed move, markets interpret Tokyo’s warnings as expressions of concern, not intent. Japan’s reliance on rhetoric - what some analysts call “soft signalling” - is increasingly ineffective in the face of strong dollar momentum and global rate divergence.

USD/JPY traders’ calculus - between conviction and caution

Market participants are split across three scenarios:

- Continuation: USD/JPY extends higher toward 155, prompting Tokyo to intervene directly in the FX market.

- Correction: A surprise BOJ rate hike or coordinated policy statement sparks a short-term yen recovery.

- Consolidation: The pair trades sideways between 153–154 while awaiting new wage and inflation data.

Futures data show yen short positions at multi-month highs - leaving the market vulnerable to a sudden squeeze if sentiment shifts. To navigate this volatility, many traders rely on Deriv’s trading calculator to measure position size and risk exposure as the pair tests critical levels.

Credibility becomes Japan’s real currency

Every move above 154 highlights Japan’s broader challenge: restoring trust in its policy direction. The yen’s weakness is no longer just about interest-rate differentials - it’s a reflection of belief, or the lack of it, in the BOJ’s conviction to act.

Unless Ueda and his team follow through with clear policy steps, markets will continue to test the limits of Japan’s resolve. The next 100 pips - between 154 and 155 - may define how long verbal warnings can substitute for real action.

USD/JPY technical analysis

At the time of writing, USD/JPY trades near 154.28, maintaining a strong uptrend. The pair continues to hover near the upper Bollinger Band, signalling strong buying interest but also a risk of short-term overextension.

The RSI is approaching the overbought zone (above 70), suggesting that momentum could soon slow. Should the RSI cross higher, a temporary pullback might occur as traders take profit.

Key support levels to monitor are 150.25 and 147.05. A break below 150.25 could spark heavier liquidation, while sustained weakness below 147.05 would indicate a deeper shift in sentiment.

USD/JPY investment implications

For traders, a USD/JPY price above 154 reinforces the short-term bullish case for the dollar, supported by diverging interest rate paths.

- Short-term strategies may favour buying dips near 153.50–153.80, while staying alert to risks of government intervention around 155.

- Medium-term investors, however, should tread carefully - any unexpected BOJ action or Fed shift could quickly unwind bullish trades.

- For portfolio managers, yen volatility continues to offer both carry trade potential and macro hedging opportunities. Using Deriv’s risk tools, such as the trading calculator can help assess exposure and manage leverage across multi-asset portfolios.

Traders looking to capture these swings can analyse live setups on Deriv MT5, where comprehensive charting and technical indicators support detailed yen analysis.

The performance figures quoted are not a guarantee of future performance.