Bitcoin moves higher as macro tailwinds push crypto into banks

Bitcoin moves higher as macro tailwinds push crypto into banks

Bitcoin moves higher as macro tailwinds push crypto into banks

.webp)

Bitcoin’s recent advance is being fuelled by macroeconomic relief rather than crypto-specific excitement. Cooling US inflation, improving global liquidity conditions, and a carefully signalled shift in Japanese monetary policy have lifted risk assets across markets. Analysts note that crypto is once again responding to the same forces driving equities and currencies, rather than trading solely on internal narratives.

During Asian hours, Bitcoin climbed above $87,000, with ether and major altcoins tracking the move higher. Analysts added that the rally reflects a growing consensus that, despite headline rate increases, monetary policy remains broadly accommodative. What sets this move apart, however, is not just the macro backdrop, but what is happening beneath the surface. As prices recover, Bitcoin is steadily being integrated into the banking system. Nearly 60% of the largest US banks are now preparing to offer Bitcoin-related services, marking a shift from experimentation to institutional adoption.

What’s driving the crypto rally?

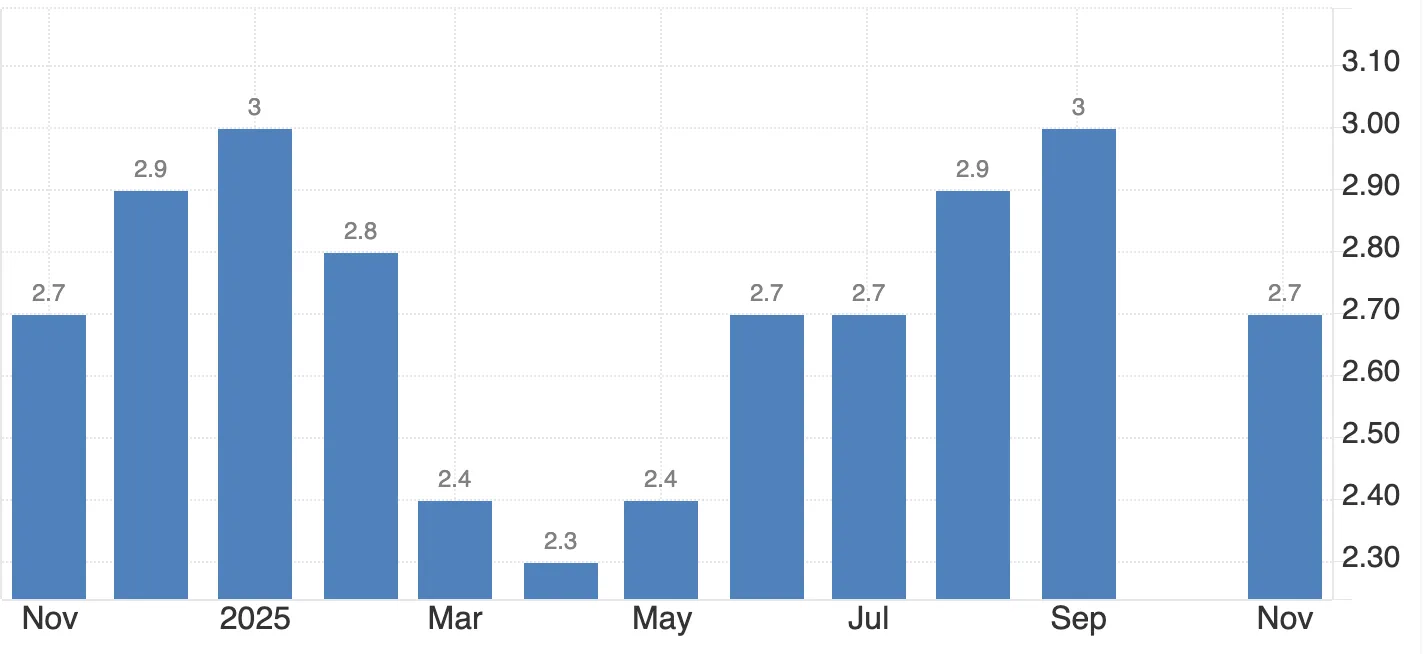

The primary trigger came from central banks rather than developments within crypto markets. The Bank of Japan lifted its benchmark rate to 0.75%, the highest level in almost three decades, briefly pushing 10-year government bond yields to 2% for the first time since 2006.

Rather than unsettling markets, the decision was absorbed with little disruption. The yen weakened, Asian equities rose, and investors interpreted the move as confirmation that real interest rates remain negative and financial conditions remain supportive.

At the same time, US inflation data came in softer than expected, reinforcing expectations that the Federal Reserve could pivot towards rate cuts later in the year.

Together, these developments eased financial conditions and reignited demand for risk assets, including crypto. Bitcoin and ether broke through nearby technical thresholds, while broader crypto markets advanced even as leveraged positions were flushed out. This type of macro-driven rally underscores how Bitcoin is increasingly behaving like a global liquidity proxy, responding to the same signals that influence traditional asset markets, according to experts.

Why Bitcoin is entering the banking system now

While price action reflects shifting macro expectations, a more structural change is unfolding in parallel. For much of the past decade, US banks kept Bitcoin at arm’s length. Regulatory uncertainty, balance-sheet considerations, and custody risks made direct involvement unattractive. That stance is now evolving.

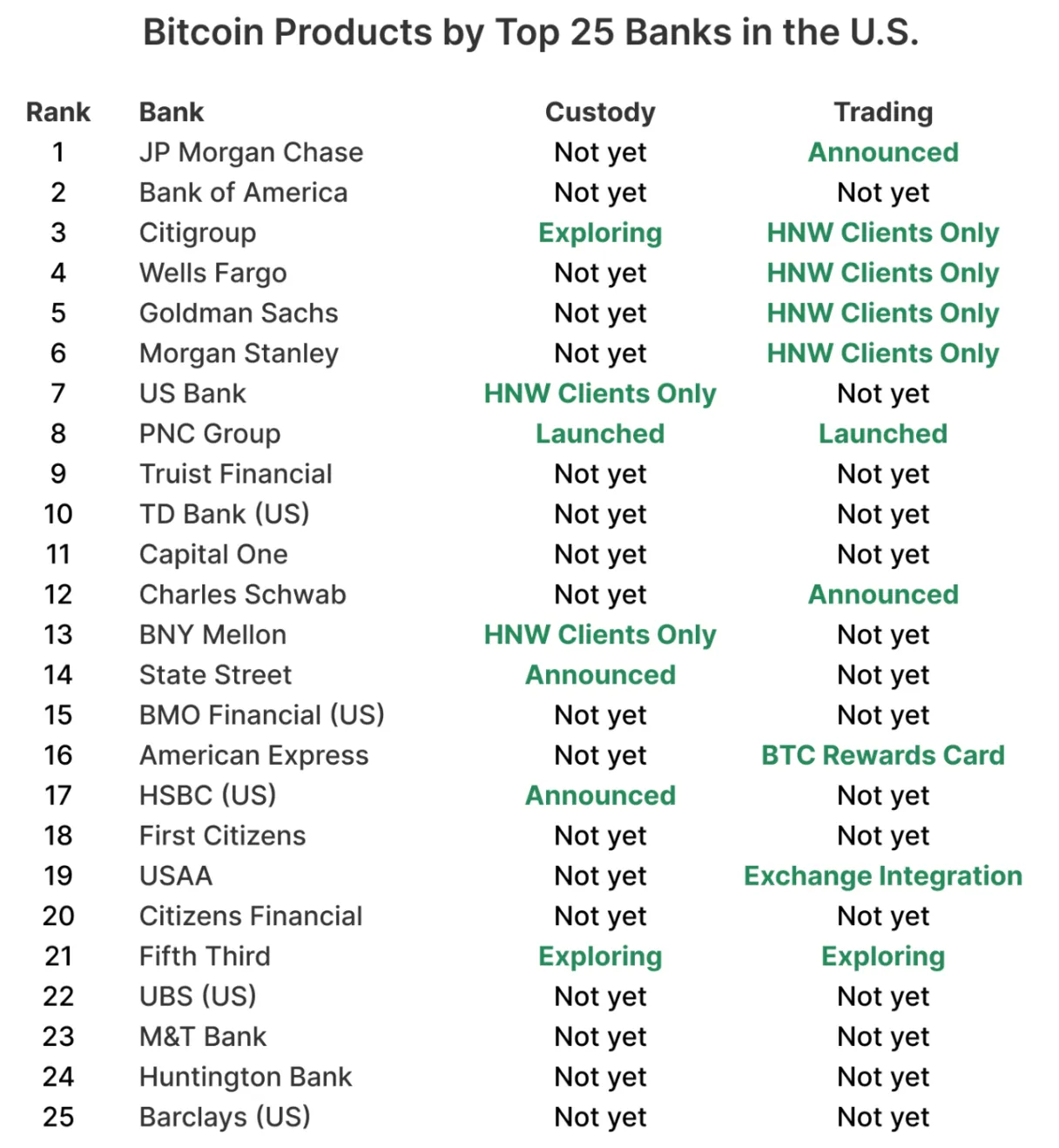

Data from River shows that nearly 60% of the top 25 US banks are moving towards offering Bitcoin exposure, whether through custody, trading, or advisory services.

The approval of spot Bitcoin ETFs in 2024 marked a decisive inflection point. ETFs allowed banks to satisfy client demand using familiar structures while outsourcing operational complexity. Importantly, large inflows and outflows were processed without disrupting markets, reassuring risk teams that Bitcoin could be accommodated within existing controls.

The focus is now shifting towards direct access. Banks are beginning to allow selected clients to hold and trade Bitcoin through the same interfaces used for equities and foreign exchange, signalling that crypto is becoming part of standard portfolio infrastructure rather than a peripheral allocation.

How banks are doing it without owning the risk

Reports revealed that most banks are avoiding the complexity of building crypto systems internally. Instead, they are adopting white-label arrangements that separate client-facing services from backend infrastructure. PNC’s private bank illustrates this approach. By using Coinbase’s Crypto-as-a-Service platform, the bank maintains control over client relationships and compliance while outsourcing execution and custody.

Regulatory developments have made this model more viable. Guidance from the Office of the Comptroller of the Currency allows banks to structure crypto trades as riskless principal transactions, enabling near-simultaneous buying and selling through liquidity providers. This significantly reduces market risk and facilitates the integration of Bitcoin services alongside existing trading desks.

Expansion remains measured. Banks are prioritising experienced clients and limiting early access. Charles Schwab and Morgan Stanley have indicated that spot Bitcoin and Ethereum trading could be introduced on self-directed platforms in the first half of 2026, likely accompanied by strict allocation limits and conservative risk controls.

What this means for crypto markets

As Bitcoin becomes embedded within regulated wealth platforms, market dynamics are starting to shift. Market watchers expressed that institutional flows are increasingly concentrating on Bitcoin, while altcoins remain more exposed to swings in liquidity and leverage. Recent trading patterns reflect this divergence. Bitcoin has benefited from macroeconomic relief, while assets such as XRP have struggled to regain key levels despite elevated trading volume, a sign that larger players may be reducing exposure rather than adding risk.

Recent data showed that ETF activity is reinforcing the trend. Bitwise estimates that Bitcoin ETFs have absorbed close to twice the amount of BTC mined since their launch and expects institutional vehicles to continue outpacing new supply. As ownership broadens and holding periods lengthen, Bitcoin’s volatility is expected to moderate, potentially falling below that of some large technology stocks.

Risks remain as highlighted by experts. Banks are relying on a relatively small group of crypto infrastructure providers, creating operational concentration. A disruption at one of these providers could have far-reaching effects. Even so, the broader direction is unmistakable: Bitcoin exposure is increasingly being institutionalised.

Expert outlook

Arthur Hayes has framed the current environment through a macroeconomic lens, arguing that persistently negative real interest rates in Japan could drive capital into Bitcoin as a form of protection against currency erosion. His $1 million price projection is extreme, but it reflects a broader shift in how Bitcoin is discussed - less as a technological experiment and more as a monetary asset.

More conservative views point to a gradual transition. Bitwise suggests the traditional four-year crypto cycle is losing relevance as ETF demand, regulatory clarity, and institutional participation outweigh halving-driven dynamics. On-chain data from K33 Research indicates that long-term holders are nearing the end of a prolonged distribution phase, potentially reducing selling pressure.

Liquidity will be the key variable. Continued macro support could reinforce stability, while abrupt tightening would test the resilience of crypto’s expanding institutional framework.

Key takeaway

Bitcoin’s recent gains are rooted in macroeconomic relief, but the underlying shift is structural. As global monetary conditions ease, US banks are weaving Bitcoin into wealth management, custody, and advisory services. This convergence is transforming Bitcoin from a specialist asset into a standard financial instrument. The next phase will hinge less on headline price targets and more on how effectively crypto integrates into the core systems of global finance.

Bitcoin technical insights

Bitcoin is consolidating near the lower Bollinger Band, a pattern that suggests sustained downside pressure while also increasing the likelihood of short-term stabilisation. Such compression often precedes a pickup in volatility, particularly when macro developments continue to influence flows. On Deriv MT5, this tightening range is evident following recent liquidation-driven swings.

The price remains capped below the $94,600 area, which continues to act as a firm resistance zone despite multiple failed attempts to rebound. Without a decisive break above this level, upside moves are likely to remain corrective. On the downside, $84,700 is a key support to watch. A clear move below it could trigger renewed sell-side pressure, given the still-elevated use of leverage across the cryptocurrency market.

Momentum indicators offer a mixed picture. The RSI has edged higher but remains below the midpoint, indicating tentative buying interest rather than strong conviction. Traders assessing risk around these levels may find tools such as the Deriv trading calculator useful for evaluating exposure and margin requirements as technical levels and macro headlines interact.

The performance figures quoted are not a guarantee of future performance.