Will Bitcoin price overcome liquidation fears with 401(k) adoption on the horizon?

Will Bitcoin price overcome liquidation fears with 401(k) adoption on the horizon?

Will Bitcoin price overcome liquidation fears with 401(k) adoption on the horizon?

Yes, analysts argue that while Bitcoin’s price in 2025 is exposed to $12.5 billion in potential liquidations, the prospect of opening $9.3 trillion in 401(k) retirement assets to crypto represents a long-term adoption catalyst. The short-term outlook remains fragile, with cascading sell-offs a real risk, but the combination of retirement flows, institutional demand, and macroeconomic shifts supports the view that Bitcoin could overcome liquidation pressures and move toward higher targets, including $200,000.

Key takeaways

- Roughly $12.5 billion in leveraged positions could be liquidated if Bitcoin falls just 5% from current levels.

- US lawmakers are pressing the SEC to implement an Executive Order enabling 401(k) crypto exposure, unlocking $9.3 trillion in assets.

- Even a 1% allocation from 401(k) accounts would amount to $122 billion in inflows, potentially propelling Bitcoin toward $200,000.

- Institutions such as MicroStrategy, Metaplanet, and Strive continue to accumulate Bitcoin during price dips.

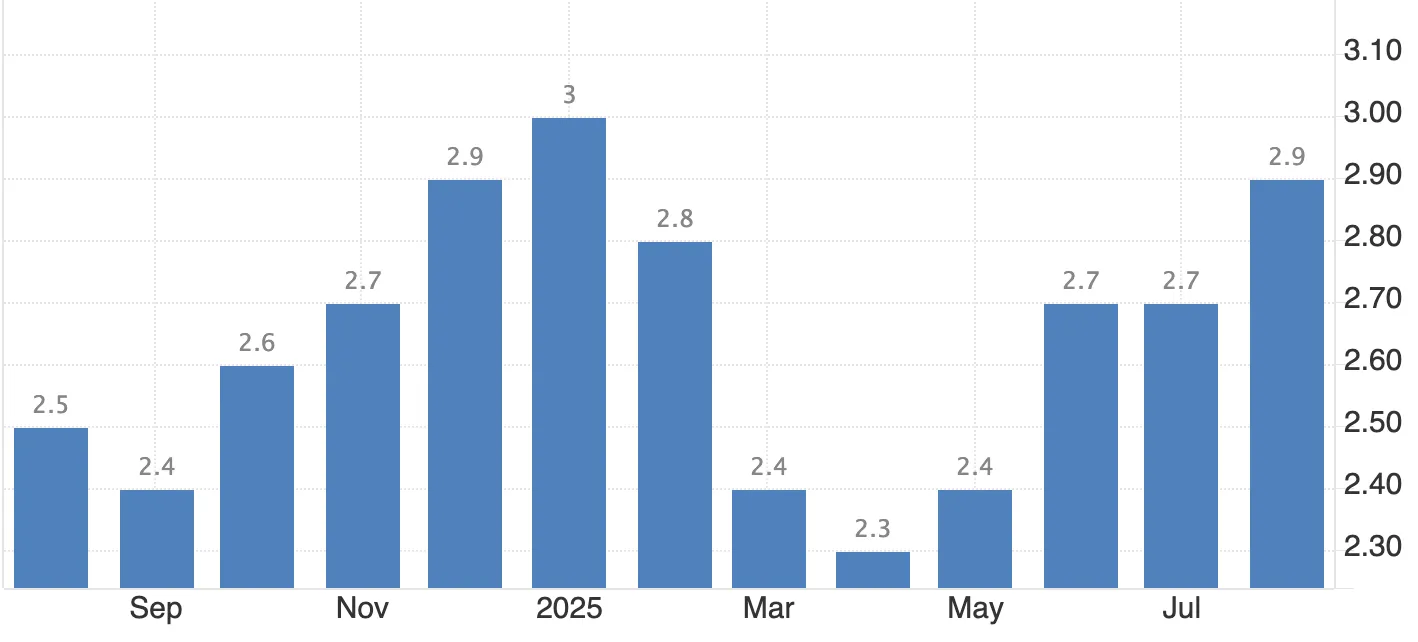

- The Fed’s September 2025 rate cut, despite inflation at 2.9%, has reinforced Bitcoin and gold as hedges against policy uncertainty.

Bitcoin faces $12.5B liquidation risk

CoinGlass data shows more than $12.5 billion in leveraged Bitcoin positions across major exchanges, with $4.8 billion on Binance, $2.7 billion on Bybit, and billions more on OKX.

With Bitcoin trading near $112,000, even a 5% drop could unleash forced selling. This mechanism is familiar: when traders using leverage cannot meet margin calls, exchanges liquidate positions automatically, pushing prices lower and triggering further liquidations.

The May 2021 crash was a clear example, when Bitcoin tumbled 12% in hours, erasing $10 billion in positions. Research has found that leverage can magnify market swings by 30–40%, underscoring how small moves can become systemic shocks.

For now, the risk of cascading sell-offs keeps short-term sentiment fragile.

Bitcoin 401(k) adoption could change the market’s trajectory

In August 2025, President Trump signed an Executive Order calling for broader access to alternative assets, including crypto, in retirement plans. Earlier this month, lawmakers urged the SEC to act swiftly on its implementation.

U.S. 401 (k) accounts currently hold about $9.3 trillion. By comparison, the entire global crypto market cap stands at roughly $3.9 trillion. A modest 1% allocation from retirement plans would generate $122 billion in inflows - nearly half of Bitcoin’s annual trading volume. Analysts suggest such a shift could push Bitcoin’s price far beyond $200,000.

Crucially, retirement accounts have so far only been able to access crypto through ETFs or equities linked to the sector. Direct exposure would represent a structural shift, embedding Bitcoin in mainstream portfolios.

Institutions keep accumulating

Institutional players are positioning ahead of regulatory changes. MicroStrategy recently bought $99.7 million worth of Bitcoin, while Japan’s Metaplanet added $632 million, raising its holdings to 25,555 BTC valued at nearly $3 billion. Strive also committed $675 million following its merger with Semler Scientific, taking its reserves above 10,900 BTC.

These are not speculative trades but long-term balance sheet strategies. The pattern shows that institutions view Bitcoin as a core reserve asset, not a cyclical gamble, and are comfortable adding exposure during volatile periods.

Macro policy is reinforcing Bitcoin demand

The Fed’s September 2025 rate cut, delivered despite 2.9% Core PCE inflation, was the first of its kind in more than 30 years. The move highlights policymakers’ focus on labour market weakness, even at the expense of price stability.

For investors, that policy stance raises doubts about fiat stability and increases the appeal of alternatives. Bitcoin and gold have both gained as hedges against monetary instability, strengthening their role in diversified portfolios. Coupled with the prospect of retirement flows, this macro backdrop adds support to Bitcoin’s long-term trajectory.

Market scenarios for Bitcoin price

- Short term: Bitcoin remains vulnerable to liquidation shocks. A 5–10% pullback could trigger billions in forced selling, repeating patterns seen in past crashes.

- Medium term: Rising numbers of 401k millionaires - now 595,000 as of June 2025 - and continued institutional accumulation point to steady inflows.

- Long term: Even modest retirement allocations could reshape demand, with inflows of $200 billion or more outweighing the risks posed by leverage. Analysts see scenarios where Bitcoin surpasses $200,000 if these flows materialise.

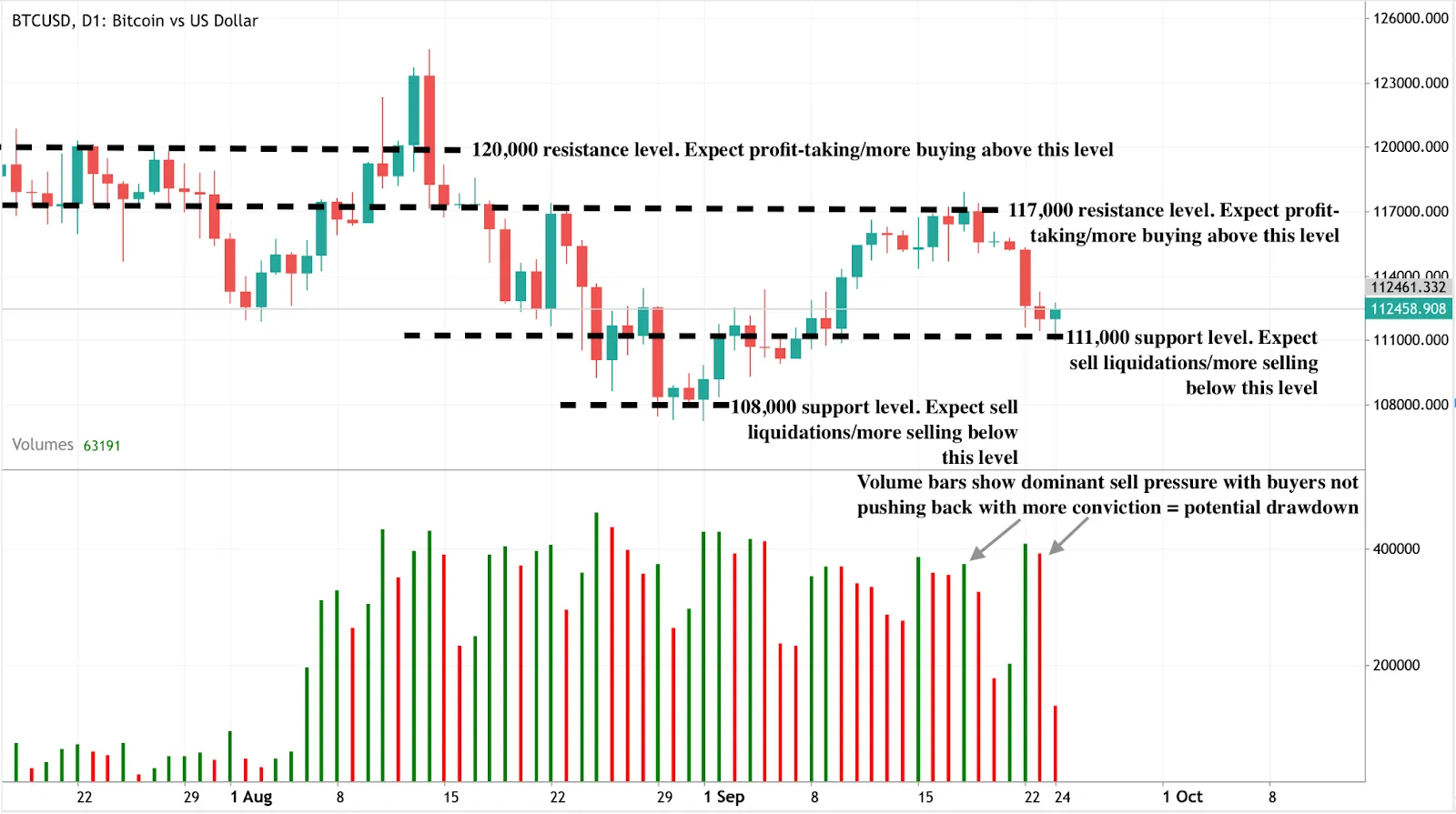

Bitcoin technical insights

At present, Bitcoin trades around $112,458, hovering above the $110,000 support line. If that level breaks, the next key support sits at $108,000. On the upside, resistance levels are noted at $117,000 and $120,000. Current volume data suggests sellers still hold some control, but any rebound above $117,000 could shift momentum back to buyers.

Bitcoin investment implications

The leverage overhang means risk management is critical for traders. Stop-loss discipline and position sizing remain essential, as even small moves could spark outsized volatility.

For medium-term investors, institutional activity provides reassurance. Companies are accumulating despite near-term risks, suggesting that periods of weakness may serve as tactical entry points.

For long-term investors, the 401(k) adoption story is decisive. Retirement flows on the scale of trillions represent a structural shift that could embed Bitcoin in mainstream finance and significantly revalue the asset. In this framework, short-term liquidations become noise against a backdrop of adoption-led demand.

Disclaimer: The performance figures quoted are not a guarantee of future performance.