Google’s AI comeback: What’s driving the rally?

Google’s AI comeback: What’s driving the rally?

Google’s AI comeback: What’s driving the rally?

.webp)

Google’s apparent fall behind OpenAI has been a recurring theme since ChatGPT reshaped public expectations for AI in late 2022. But the narrative is shifting. A series of rapid-fire product releases, strategic chip partnerships and renewed investor confidence has prompted a re-evaluation of Google’s position in the AI race.

Much of that momentum centres on Gemini 3, Google’s new flagship model. Its performance across reasoning, coding and specialist tasks has impressed analysts and reinforced the sense that Google may not only be catching up - it may be surging ahead. As demand rises for cloud compute and Google’s home-grown AI hardware, the question is no longer whether Google can reclaim lost ground, but what exactly is powering this rally.

What’s driving Google’s resurgence?

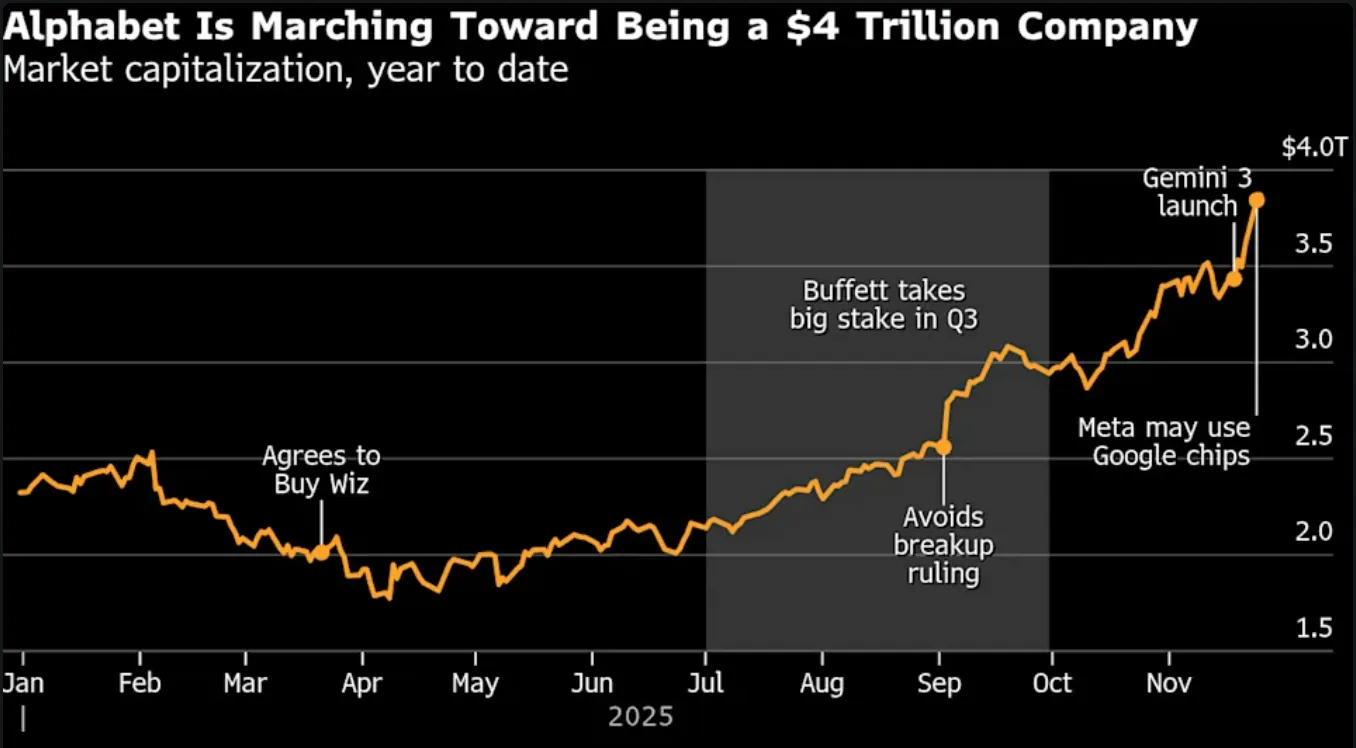

Alphabet shares have climbed sharply since mid-October, with the stock touching $323.64 and putting the company on the verge of joining the rare $4 trillion market-cap club.

Behind that rise lies a combination of technical advances and strategic consolidation. Gemini 3 vaulted to the top of key AI leaderboards, including LMArena and Humanity’s Last Exam, earning praise for its ability to handle complex scientific reasoning and tasks that often expose weaknesses in rival chatbots. Its progress in reducing errors - especially in generating images with correctly spelled overlaid text - signals a maturity that matters to enterprises vetting AI models for real operations. At the same time, updates to tools such as the Nano Banana generator keep Google’s consumer and developer ecosystems highly engaged.

A second major force is hardware. Long criticised for lagging behind Nvidia and lacking a competitive chip strategy, Google is now benefiting from renewed interest in its Tensor Processing Units (TPUs). These specialised processors, developed over more than a decade, are attracting attention from major platforms.

Reports that Meta is exploring the use of Google’s chips in its data centres by 2027 fuelled a notable rally in Alphabet stock, marking a potential turning point in the AI hardware landscape. Agreements with Anthropic - potentially involving up to one million TPUs - further reinforce Google’s growing weight in the AI compute market.

Why it matters

Google’s resurgence carries consequences that ripple far beyond its own valuation. As Neil Shah of Counterpoint Research put it, “Google has arguably always been the dark horse in this AI race - a sleeping giant now fully awake.” If Gemini 3 continues to deliver on benchmarks, it could reshape the triangle of AI power: OpenAI as the model innovator, Nvidia as the hardware anchor, and Microsoft as the enterprise gateway. A stronger Google disrupts this structure and gives companies more room to diversify away from Nvidia’s expensive GPUs or Microsoft’s deep integration with OpenAI.

Regulators and consumers stand to feel the effects as well. Google avoided the harshest potential penalties in a recent US antitrust case partly because the rise of AI rivals was seen as intensifying competition. Should Google sustain its pace, it may help keep regulatory pressure in check while accelerating adoption of AI features outside its core advertising business.

Units like Waymo, now expanding into new US cities and offering highway-capable autonomous rides, show how Alphabet’s research-heavy ecosystem translates into real-world deployments beyond software. The outstanding question is whether Google can turn this technical advantage into sustained commercial leadership.

Impact on industry, markets and consumers

Google’s rebound creates both opportunity and disruption across the tech sector. Nvidia - long the de facto supplier of AI compute - saw about $150 billion erased from its market value after the Meta chip discussions surfaced, underscoring the market’s sensitivity to potential competitors.

Nvidia still argues that its GPUs remain unmatched in flexibility and broad capability, and for now that remains true. But TPUs offer a meaningful alternative for targeted, large-scale AI workloads, and analysts expect custom ASIC designs to grow faster than the GPU market over the coming years.

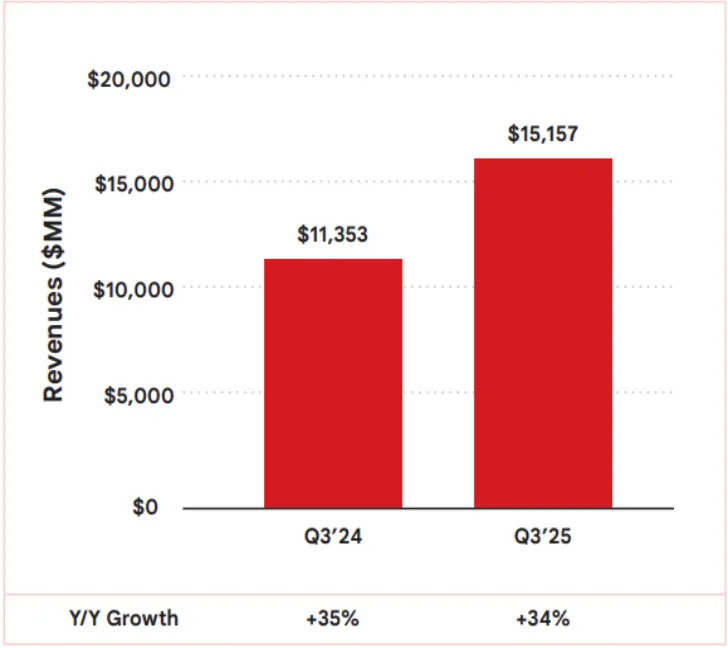

This shift also reshapes the cloud industry. Google Cloud reported $15.2 billion in third-quarter revenue, up 34% year-on-year, narrowing its longstanding gap with AWS and Microsoft Azure. Some enterprise clients may choose Google Cloud specifically for TPU-based workloads while maintaining GPU-heavy tasks on other platforms.

For consumers, the result is a wave of more capable AI tools - cleaner outputs, improved reasoning and better safeguards - driven by heightened competition at the infrastructure level.

In financial markets, Alphabet’s rally affects index weightings and sector rotations, particularly within tech-heavy indices. As traders digest shifting expectations around Google’s valuation and the future of AI hardware, volatility spikes in related equities like Nvidia, AMD, Microsoft and Meta. Platforms like Deriv MT5 enable traders to act on these swings in real-time across stock CFDs and major indices. The Deriv Trading Calculator remains a key tool for assessing margin, exposure and risk before entering positions in fast-moving AI-driven markets.

Expert outlook

Analyst opinions diverge on where Google’s revival goes next. Optimists argue that Google’s “full-stack” strategy - spanning data, models, chips, cloud infrastructure and applications - is finally delivering on its promise. CEO Sundar Pichai noted on the latest earnings call that this end-to-end approach “really plays out” when scaling frontier models with reasoning, multimodal capability and heavy coding functions.

If Google maintains its pace, it could reduce reliance on Nvidia’s ecosystem while challenging Microsoft and OpenAI on enterprise adoption. However, challenges remain. Gemini’s growth, while impressive, still trails ChatGPT: 650 million users versus ChatGPT’s 800 million weekly users, and 73 million monthly downloads versus ChatGPT’s 93 million, according to Sensor Tower.

Google Cloud is expanding rapidly, but it still operates at roughly half the scale of AWS and Azure. The broader view among cautious analysts is that unless Google converts its technical gains into commercial wins, market momentum could cool. Much depends on whether Meta formalises its TPU deployment and whether Gemini 3 sustains its real-world performance advantages. The next six to nine months will determine whether Google’s resurgence solidifies or stalls.

Key takeaway

Google’s AI comeback is no longer speculative - Gemini 3’s strong benchmarks, rising TPU demand and accelerating cloud revenue point to a company regaining leadership in a field it once dominated. Alphabet’s sharp rally reflects a shift in how investors value Google in the AI era.

But the story is far from finished. Sustaining this momentum depends on Google converting engineering breakthroughs into commercial traction, expanding cloud partnerships and proving TPU competitiveness at scale. For traders and analysts, the signals to watch include enterprise uptake of Gemini, chip-supply agreements and quarterly cloud revenue - the indicators that will show whether this rally becomes a new AI chapter for Google or a brief surge before consolidation.

Alphabet technical insights

At the time of writing, Alphabet (GOOG) has pushed decisively into a price discovery area above $323, extending a strong breakout along the upper Bollinger Band. The $268.75 and $240 levels remain key supports; a sustained move below either could trigger heavier selling pressure or prompt a broader pullback.

The RSI sits near 74, suggesting short-term overbought conditions. This increases the likelihood of a pause or mild consolidation, even if the longer-term trend remains upward.

The performance figures quoted are not a guarantee of future performance.