Oil price analysis: WTI holds above $65 as supply risks collide with Iraqi exports

Oil price analysis: WTI holds above $65 as supply risks collide with Iraqi exports

Oil price analysis: WTI holds above $65 as supply risks collide with Iraqi exports

Oil prices - the global benchmark for energy costs - are closely watched as they influence inflation, consumer prices, and investment flows across markets. After weeks of sideways trading, crude has broken higher, with West Texas Intermediate (WTI) now consolidating just above $65.

The rally has been fuelled by a surprise U.S. inventory draw, Russia’s fresh export restrictions, and continued Ukrainian strikes on Russian energy infrastructure. But the big question for traders is whether WTI has the momentum to push toward $70, or whether resumed exports from Iraq and Kurdistan will reintroduce oversupply fears.

Quick summary

- U.S. crude inventory draw → bullish surprise → WTI lifted above $65

- Ukrainian drone attacks → Russian export bans → tighter global supply fears

- Shale breakeven costs rising → weaker ability to offset shocks → higher price floors

- Iraq/Kurdistan exports returning → oversupply narrative → capped upside

- U.S. growth strong → higher demand but hawkish Fed → mixed outlook

Price moves: Brent and WTI hit seven-week highs

- Brent crude - the international oil benchmark - rose 2.48% to $69.31.

- WTI crude, the U.S. benchmark, gained 2.49%, settling just above $65.

Both contracts reached their highest levels in seven weeks, confirming renewed bullish momentum in oil markets.

U.S. inventory draws ignite price momentum

The Energy Information Administration (EIA) - the U.S. Department of Energy’s data agency - reported a 607,000-barrel decline in crude stocks, compared with forecasts for a 235,000-barrel build.

Refined products also saw broad-based declines:

- Gasoline inventories fell.

- Distillates also dropped.

Together, these draws signalled tighter balances and demand resilience, providing the spark that pushed WTI beyond $65.

Russia’s export bans and supply fragility

Russia remains central to crude volatility. Deputy PM Alexander Novak extended the gasoline export ban and partially halted diesel shipments through year-end.

- The decision followed Ukrainian drone strikes on refineries and pumping stations.

- Russia’s Novorossiisk port declared a state of emergency, underscoring risks to infrastructure.

With Russian barrels already limited by sanctions, every additional disruption raises global supply concerns.

Turkey, Trump, and energy politics

Energy markets spilled into geopolitics as Donald Trump pressed Turkey to halt Russian oil imports in exchange for a potential return to the F-35 fighter jet programme.

Turkey, a NATO member but a key buyer of Russian energy, has resisted such moves. While no commitments emerged, the episode highlighted how oil flows remain tied to U.S. security and defence negotiations, adding another layer of uncertainty for traders.

Shale’s higher-cost era

Once the global “safety valve,” U.S. shale is entering a new phase:

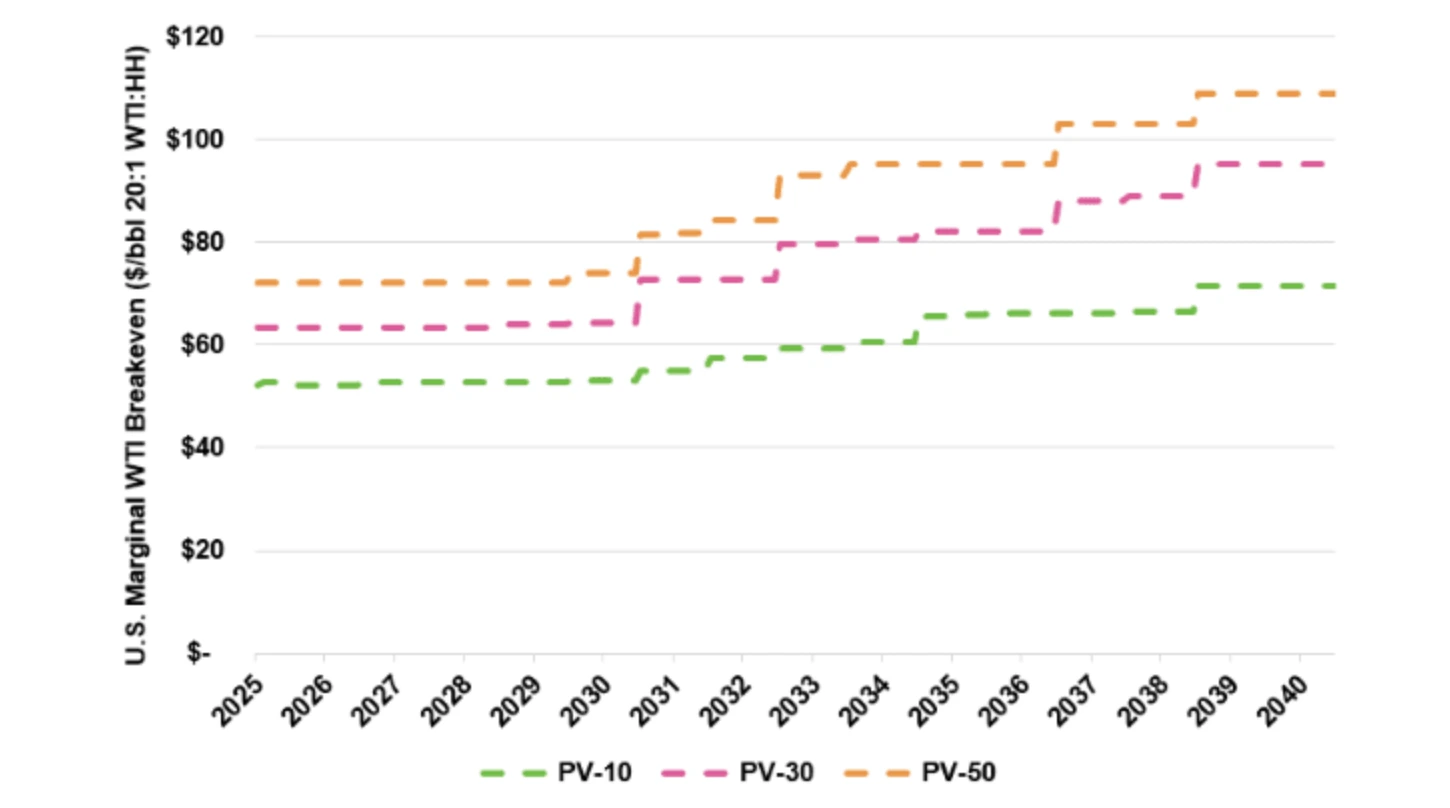

- Enverus Intelligence Research projects shale breakevens rising from ~$70 to $95 by the mid-2030s.

- Top acreage is depleting, forcing drilling in less productive areas.

- Diamondback Energy has trimmed budgets amid price uncertainty.

- The Dallas Fed energy survey noted widespread delays and described a “new era of higher costs.”

This means shale can no longer rapidly scale up to stabilise global prices - leaving the market more exposed to supply shocks.

Iraq and Kurdistan’s exports may ease the tightness

The Kurdistan Regional Government announced exports will resume within 48 hours after reaching a deal with Baghdad and the producing companies.

If sustained, this return of Kurdish crude could offset the bullish narrative. Combined with stable OPEC+ output, it raises the risk of oversupply capping further rallies.

Macro backdrop: Strong U.S. growth, cautious Fed

The latest data shows U.S. GDP growth revised up to 3.8% annualised, confirming robust domestic demand.

- Stronger growth → supports oil consumption.

- But growth → reduces pressure on the Federal Reserve to cut rates.

A less dovish Fed could tighten financial conditions, creating a headwind for broader demand.

Crude oil price technical analysis

Support and resistance on Deriv MT5, WTI crude show:

- Resistance: $65.15, $68.00, and $70.00

- Support: $61.58

Volume indicators lean bullish, signalling weak selling pressure. A break above $68 could accelerate toward $70, while a slip back toward $61.58 would test demand resilience.

How to trade oil in this market

- Open a trading account via Deriv MT5

- Support near the $61.58 price level, with resistance at $68.00

- Apply stop-loss orders to manage volatility.

- Track fundamentals - EIA reports, OPEC+ announcements, and geopolitical headlines.

- Use technical indicators - RSI and moving averages to confirm trend strength.

Investment Implications

- Short-term traders: Opportunities around $61.58–$70 levels.

- Medium-term investors: Shale costs suggest higher floors, but Iraqi/OPEC+ supply could cap upside.

- Equities: Refiners and low-cost producers may outperform; high-cost projects risk margin compression.

Follow the oil price trajectory with a Deriv MT5 account.

The information contained in this blog is for educational purposes only and is not intended as financial or investment advice. The information may become outdated, and some products or platforms mentioned may no longer be offered. We recommend you do your own research before making any trading decisions. The performance figures quoted are not a guarantee of future performance.